The PPS Blog

Sell or Hold

By Jeff Banks

Property investment profits, like the numbers involved in the transaction themselves can be very large and the emotion that goes with them can be motivated by more than clinical analysis.

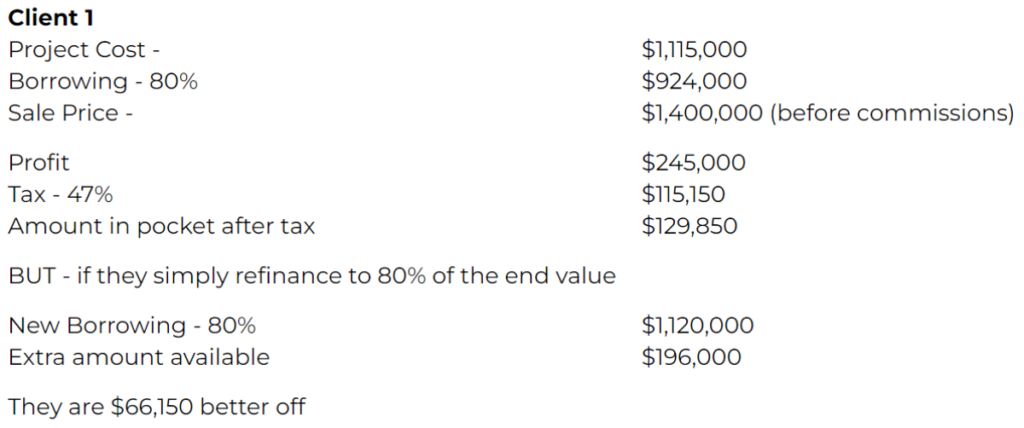

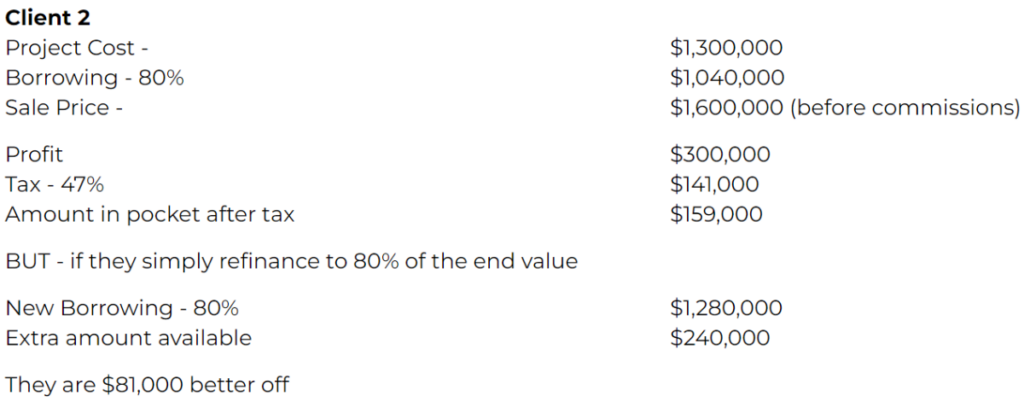

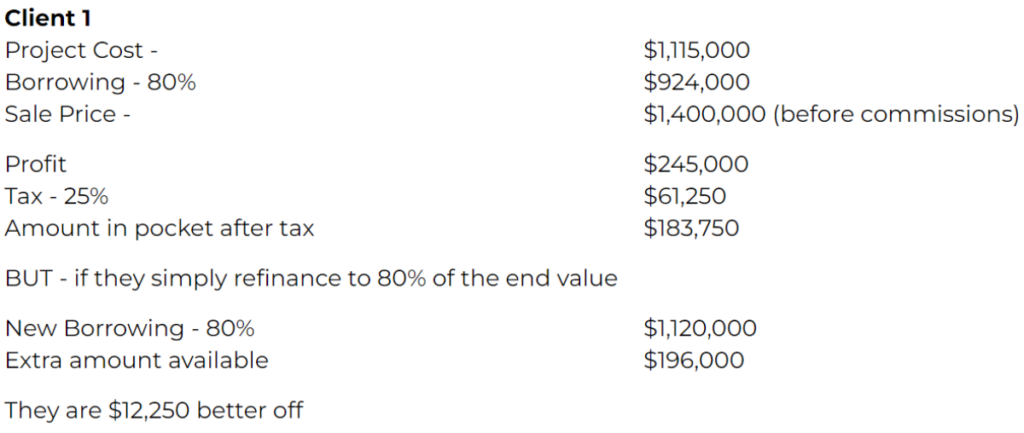

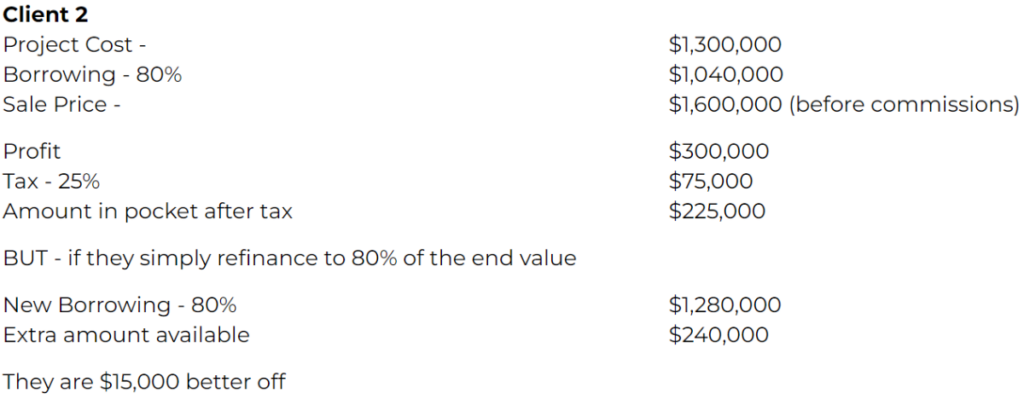

I wanted to quickly work some numbers for those or our clients looking at the end numbers in a project and wondering if it would be better to sell or hold a property once a development is completed. For this example I am going to work through 2 “live” examples where the motivation for each client is decidedly different. At the end of the building phase of each they are faced with the same conundrum, do I sell or do I hold.

The answer of course is much more complex than the simple numbers but let me run these past you:

These clients are all purchasing in their own/joint names so the final tax rate will be something like 47%, the top marginal tax rate as the profit from the individual projects is such, it places them in the highest tax bracket.

There are lots of ifs and buts and much of the final decision will be emotive, and in this case the entire reason behind the original investment was to grow savings for a deposit on their dream home so holding may not be an option. But that’s their decision, unsupported by the numbers but vital to it.

Here the quandary is quite different as they are looking to build a portfolio. Now with this property in hand they will be able to approach their bankers with an increased asset backing and more income, that should see them be able to move to the next property, rather than sell and have less starting point.

Even using a company rather than individual names, which in the short term will invoke a lesser taxation burden, the numbers still remain with refinance.

In the short term nature of what these clients were aiming to achieve, even access to the lower taxation rates allowed trading companies still did not give the best outcome. Lets look at client 2

Should I sell or should I hold. The numbers say hold but there are lots of other factors that need to be considered and that’s where the understanding of the goal and its need for achievement are paramount. There are times when bankers “get in the road” or the goal simply needs a boost and the sale becomes the answer.

For us at Property Portfolio Solutions its about the client. It is our purpose in life to ensure the goals of the client are met and the stepping stone on the journey where property is the vehicle work to that destination and arrival occurs in the shortest possible time. Like all investment compounding takes a vital role in the equations and coming from the largest base possible ensure the greatest end value.

Our catchcry is “Your legacy is Our inspiration” and our approach based on what inspires you, will make your legacy seem so much easier to achieve. We are easily contacted by going to our website www.propertyportfoliosolutions.com.au where the start or even the continuation of your property portfolio is made simple.